- Home

- The Latest

- What you should know about App ...

Tech giant Apple goes further into customers’ pocketbooks with its new high-yield savings accounts. But that’s a good thing.

A traditional bank offers savings accounts we are all familiar with. Those are the accounts our grandparents put a few dollars in every year or so. The problem is those traditional savings accounts barely pay any interest. Let’s say your grandparents put $100 into a traditional bank’s savings account. That $100 wouldn’t earn much more than 30 cents over the course of a year.

With high-yield savings accounts the $100 will earn $4-$5 in a year.

High-yield savings accounts are a lot different. There are no physical bank locations allowing online banks to offer higher rates. You do all of the banking over the phone. Apple savings accounts are even more different, adding a thick layer of convenience. Apple took the wraps off its high-yield savings accounts available to anyone with an Apple credit card.

Here’s what else you need to know before opening one.

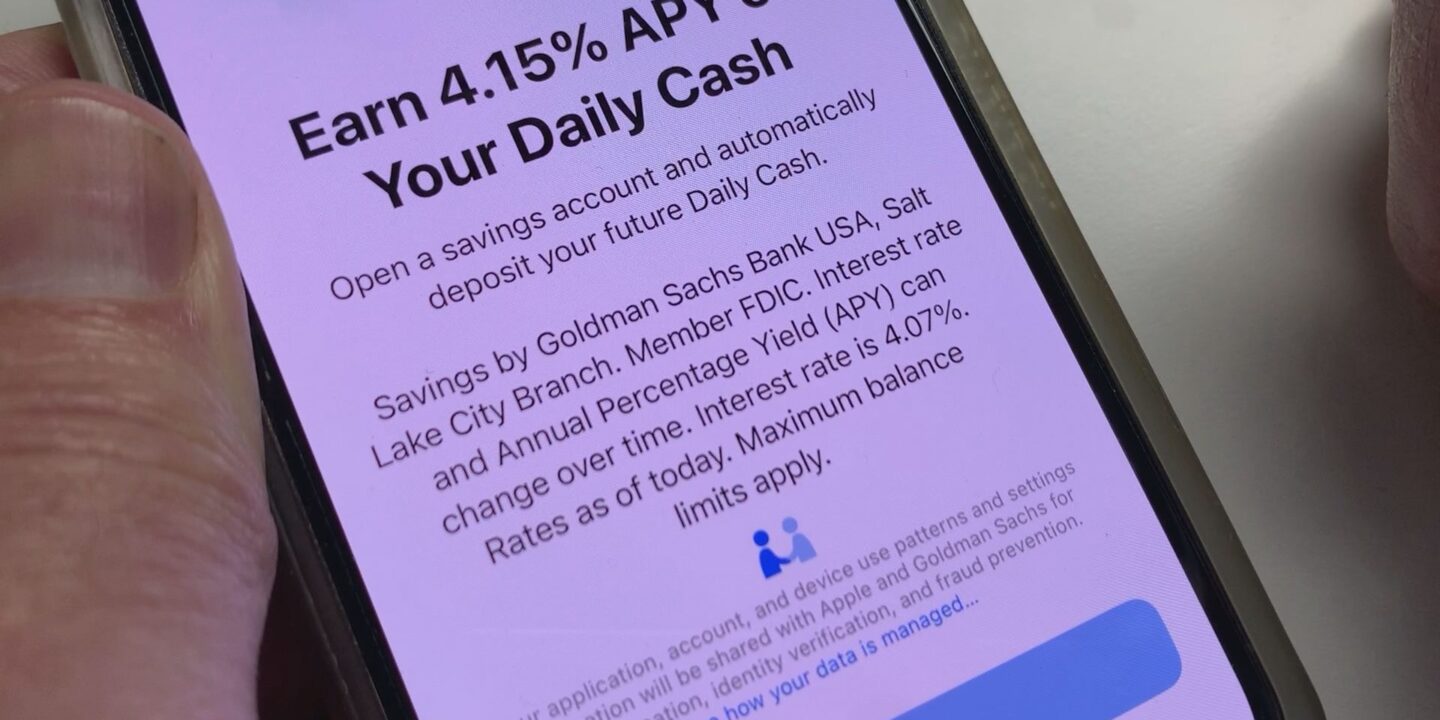

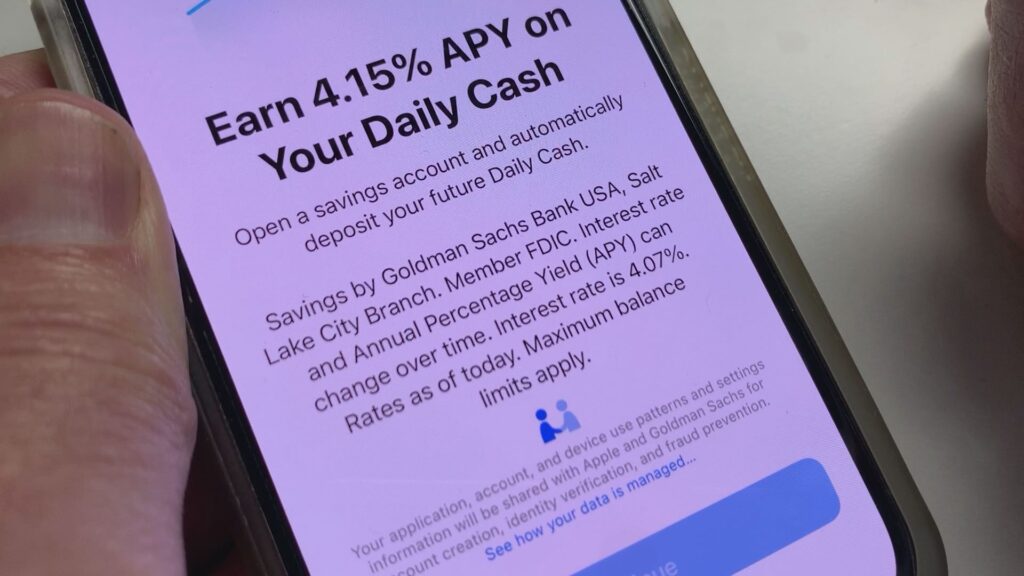

Apple’s savings accounts are through Goldman Sachs, the same bank behind Apple’s credit cards. It’s a high-yield savings account that’s currently 4.15%. Traditional bank savings accounts are around .35%. You read that right. Point 35%.

That makes a big difference over the course of time. $1,000 in a traditional savings account will earn around $3.50 a year in interest.

In a high-yield savings account like Apple’s, the same $1,000 will earn $41.50 a year in interest.

High-yield savings accounts are growing in popularity for that reason. Apple’s rate isn’t as high as other online banks, but it’s pretty close.

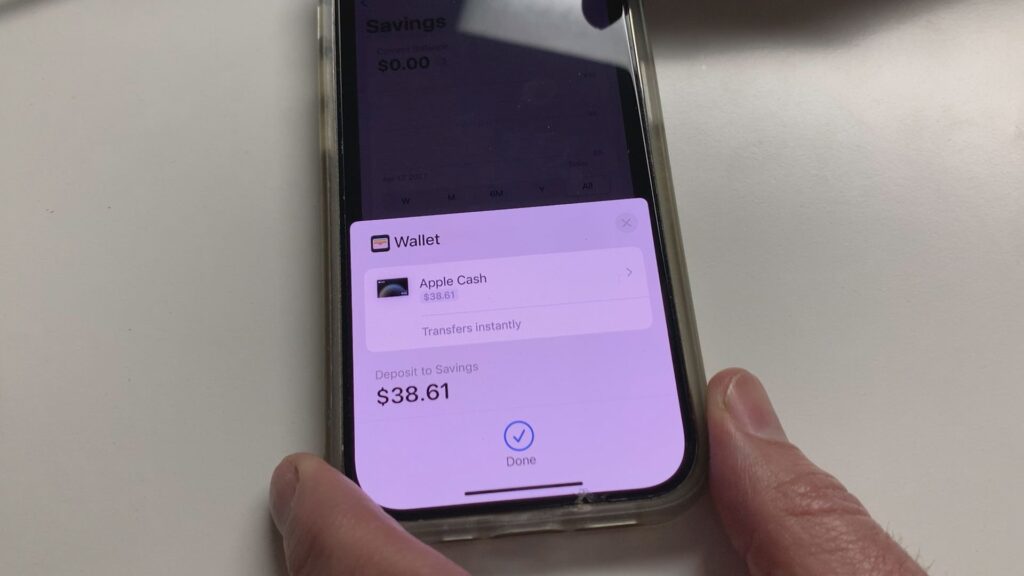

Apple savings accounts are connected to customers with Apple credit cards, earning 2%-3% cash back. Not as much as some other credit cards offering miles and points. But, the cash earned using an Apple credit card can automatically be deposited into the Apple savings account

Is putting money in and taking money out of an Apple savings account easy?

Transferring money from another saving or checking account can be done in the Wallet app provided you’re signed in to your other account.

To apply for a savings account, customers must have an Apple credit card. In the wallet app, tap Daily Cash where you’ll see an option to open a savings account.

Is an Apple savings account safe? Like most other high-yield accounts Apple/Goldman-Sachs savings accounts are FDIC insured up to $250,000.

Apple insists security for credit cards, Apple Pay, and Apple Savings are top-notch, requiring Face ID to conduct transactions.

If you do any banking with your phone, it’s important to protect your accounts with extra security such as longer passcodes or passwords, never do banking over a public wifi network, and use strong passwords you don’t use for any other account.